Equity release

Video transcript

The money you get from your property through equity release can be used for anything, much like with a secured loan or remortgage, but the main difference is you don`t have to make repayments on the cash each month.This way of securing funds has certainly been growing in popularity over the past few years, with Equity Release Council figures showing that £473 million was released in the first six months of 2013, compared to £423.9 million and £366.5 million in that period of 2012 and 2011, respectively.

So what exactly does equity release entail? It`s only available to property owners who are retired or are close to it – the minimum age is 55 years old - and it lets them borrow either a lump sum or draw down regular lump sums from the equity that`s built up in their property through their years of mortgage payments.

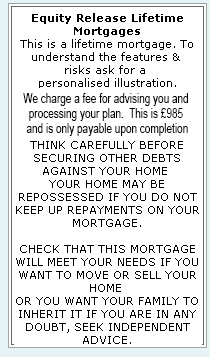

There are two types of equity release scheme – lifetime mortgages, where the money is taken directly from the property, and home reversion, where you give the provider a percentage share of your house and they provide you with a percentage of its value in return. Remember this is a lifetime mortgage.

To understand the features and risks, ask for a personalised illustration.

The capital and accrued interest are paid back through the sale of the property when you pass on or move into long-term care or sell your home, so you don`t have to worry about making repayments in between.

Some plans let you pay the some or all of the interest on the equity you release from your home to help keep the capital from growing too quickly. These are known as interest only lifetime mortgages.

Discover more about our equity release lifetime mortgage schemes by enquiring at firstchoicefinance.co.uk or by calling up on 0333 003 1505 from a mobile or 0800 298 3000 from a landline.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential

That is where we come in, if you own your own home or pay a mortgage on one, we can look into advising you on some property equity release. We specialise in finance and also provide homeowner secured loans and remortgages. These may be more suitable for you if you are under 55 or have enough income to afford to pay back any money you borrow through a more traditional fixed term loan or capital and interest remortgage. When you are ready to consider your options, then contact the office on

That is where we come in, if you own your own home or pay a mortgage on one, we can look into advising you on some property equity release. We specialise in finance and also provide homeowner secured loans and remortgages. These may be more suitable for you if you are under 55 or have enough income to afford to pay back any money you borrow through a more traditional fixed term loan or capital and interest remortgage. When you are ready to consider your options, then contact the office on  To understand property equity release, you must first understand how equity with regards to your property works. Equity is the difference between your property value and any mortgage or second mortgage (also known as a secured loan) that you have secured against it. You may have also heard this referred to as loan to value (LTV). To calculate your LTV, head over to our loan to value calculator or give us a call and we will work it out for you. If you do not have any debt currently on your home then your Loan To Value is zero, i.e. the lowest it can be.

To understand property equity release, you must first understand how equity with regards to your property works. Equity is the difference between your property value and any mortgage or second mortgage (also known as a secured loan) that you have secured against it. You may have also heard this referred to as loan to value (LTV). To calculate your LTV, head over to our loan to value calculator or give us a call and we will work it out for you. If you do not have any debt currently on your home then your Loan To Value is zero, i.e. the lowest it can be.